Wealth and Status

How much does a person's wealth affect their tendency to make risky decisions?

01

Risky Assets Distribution

The more wealth a person has, the more willing they are to place their money into risky assets. A 1992 study by Riley and Chow found that those with a net worth of over $500,000 placed seven times as much of their wealth into individual stocks as those with a net worth less than $10,000 did. While this may seem obvious, it actually displays the profound overconfidence that results from having a large sum of money that one is willing to gamble.

02

Risk Aversion Index

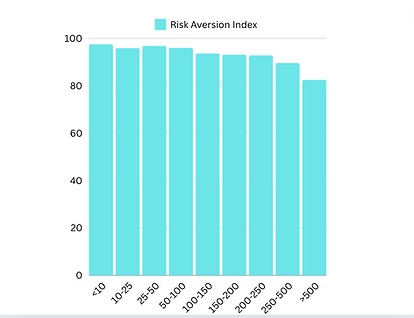

As expected, the wealthy also have a much lower risk aversion index than those who have a low net worth. The same study by Riley and Chow found that the risk aversion index for those with a net worth of over $500,000 was over 15 points higher than those with a net worth below $10,000. This means that the wealthy are far more willing to take risks than those with a lower net worth. This also holds true for high earners and not merely those with a high net worth.

03

Age and Wealth

Age and wealth cannot be viewed independently, since older people tend to have much more wealth. However, when viewed together, they lead one to conclude that older and wealthier people tend to take the most risks of all in the stock market. A 2004 study by Amit Goyal indicated as such, as age and wealth worked together to make someone more willing to take risks.